The Fed's Steady Hand: Analyzing the Decision to Keep Rates Unchanged

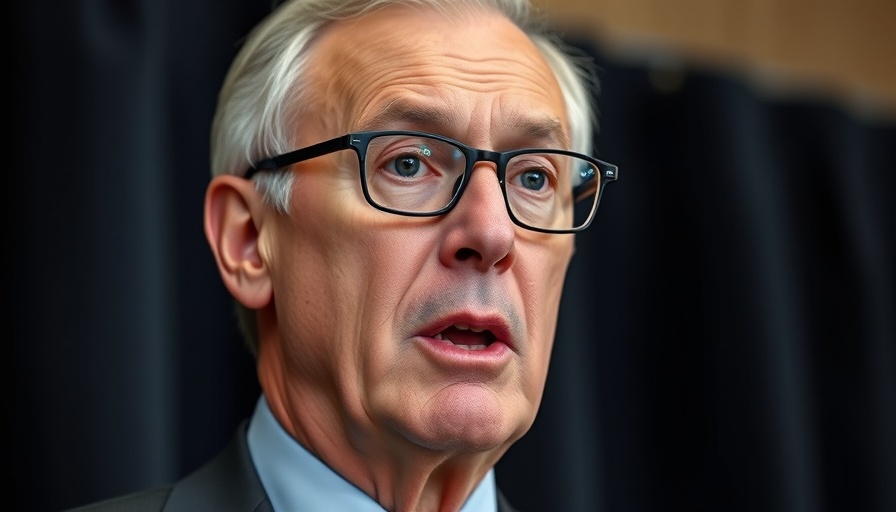

In a move that many expected, the U.S. Federal Reserve decided to maintain interest rates at a target range of 4.25% to 4.5%. This decision comes as Federal Reserve Chair Jerome Powell emphasized the need for patience and adaptability in response to ongoing economic developments, notably President Trump's trade strategies and anticipated inflationary effects from tariffs.

Why This Decision Was Expected

Experts like Elyse Ausenbaugh, head of investment strategy at J.P. Morgan Wealth Management, claim that the Fed's choice to hold rates steady is not surprising. As economic indicators show mixed signals—with inflation at 2.8% as of February and an unemployment rate of 4.1%—the Fed is prepared to assess the impact of any changes before acting. Ausenbaugh stated that investors are eagerly watching for clearer signals from upcoming Federal Open Market Committee (FOMC) meetings.

Future Implications for Business Owners

The Fed's decision has implications for business owners directly impacted by borrowing costs and consumer spending patterns. If tariffs lead to inflation, future rate cuts may hinge on employer confidence and consumer activity. Melissa Cohn, a mortgage industry veteran, echoed this sentiment, asserting that the next three months could dictate the Fed's monetary policy adjustments.

Understanding the Bigger Picture

This steady approach signals an ongoing commitment to fostering economic resilience and full employment while navigating uncertainties stemming from international trade. As businesses strategize for an unpredictable landscape, understanding the Fed's anticipatory measures can help them align their financial strategies effectively.

Take Action: Stay Informed

As a business owner, it's vital to stay updated on Federal Reserve announcements and economic forecasts. By doing so, you can make more informed decisions regarding investments, financing, and strategic planning for your business. Be proactive and adapt your strategies as the economic narrative unfolds.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add Element

Add Element

Write A Comment